The Red Flags were designed for financial mentors and other advocates to guide financial mentors when dealing with issues around hardship, unmanageable debt and irresponsible lending. The Red Flags align with the law in the Credit Contracts and Consumer Finance Act (CCCFA).

This course will help you to become more familiar with the Red Flags and through scenarios of real client cases, help you work through the issues of hardship, unmanageable debt and and irresponsible lending.

Aim of Module

To understand the options available for financial mentors to address consumer issues that contribute to client’s debt and hardship by using the Red Flags.

To keep current with law changes and corresponding resources.

Who is this course for?

Financial mentors who would like to:

- extend their understanding of the Red Flags and how to use them to address client hardship and debt

- extend their skills and ability to work with debt, advocating for their client’s rights and negotiating with creditors to ensure the law has been followed; and

- ensure clients are not disadvantaged through unfair or illegal practices.

Why explore the Red Flags?

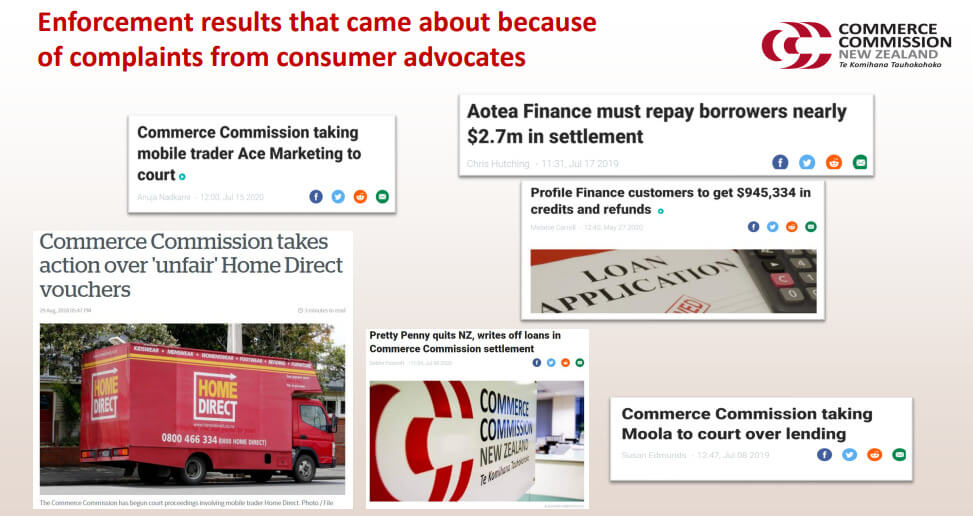

More and more of our clients are experiencing hardship due to debt. The Red Flags help financial mentors to ask questions about how the debt was attained and managed and whether there was a breach in the law. By researching the flags when you think something has gone wrong, you can better identify unlawful conduct and assist your clients to resolve problems with lenders. This can result in reducing or wiping the debt so clients can manage their finances and work towards a better future for themselves and their family.

What will you learn?

At the completion of this course you will have explored:

- different options to manage debt to support your clients

- changes to the Red Flags

- each of the 12 areas of concern (12 Flags)

- what you can do to address the issues.

Throughout this course you will be able to download some resources, current as at May 2022 and directions where to find further helpful resources.

Module Timeframe

It is expected that this course will take four hours to complete.

This course relates to two other courses on Community Heart:

- Understanding the CCCFA

- Supporting Consumer Issues.