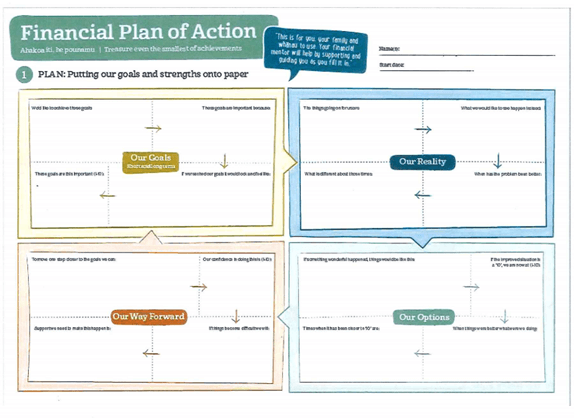

Financial Plan of Action

To complete the toolbox, we will just introduce the FPOA – the ‘Financial Plan of Action’.

This is a tool developed by the Ministry of Social Development to help the client take ownership of the budgeting process, to help and encourage them to do what is needed to meet their financial goals: be it paying debt, managing daily spending or saving for a house deposit.

Financial Plans of Action can be used in a number of ways. With some clients you can use it at the beginning of their journey. With other clients they are discussed but not filled in until you have had a few discussions.

You may have already:

- helped the client prepare their budget worksheet

- prepared a debt schedule

- helped them prioritise the repayment of their debts

- confirmed they can make the repayments (prepared a cashflow)

- you have helped them start to take ownership of their financial problems.

Coupled with helping them set some SMART financial goals (remember what we learnt in a module one), they are hopefully on their way towards improving their financial capability and are starting to think about the sections they will need to complete their Financial Plan Of Action.

As previously indicated, a lot of time can easily be consumed getting to the bottom of a client’s debt schedule and looking for ways to help them repay them by suggesting changes to their budget. And that is only after you have managed to generate a surplus in the budget in the first place.

Helping clients take ownership of their problems, and to have the skills and knowledge to solve them by themselves goes a long way to helping ensure they have financial capability for the future.

Therefore, we will cover all these tools in more detail in later modules.

You can download the FPOA here: